Elimination of Income from Investments

Last updated on 2025-12-17

Overview

The goal of the app for Elimination of income from investments is to automate the elimination of investment income recorded by the parent company against the subsidiary's dividend distributions or profit transfers in the same period.

Elimination can be executed per period or accumulated across several periods.

Non-controlling interests can be considered. They are considered based on the ownership interests stored in the master data or based on individual specifications made on the app interface.

This article contains the following sections:

Configuring the Elimination of Income from Investments

To configure the app for the Elimination of income from investments, click the app in the structure view and click Edit in the displayed dialog.

Configure the steps as described below.

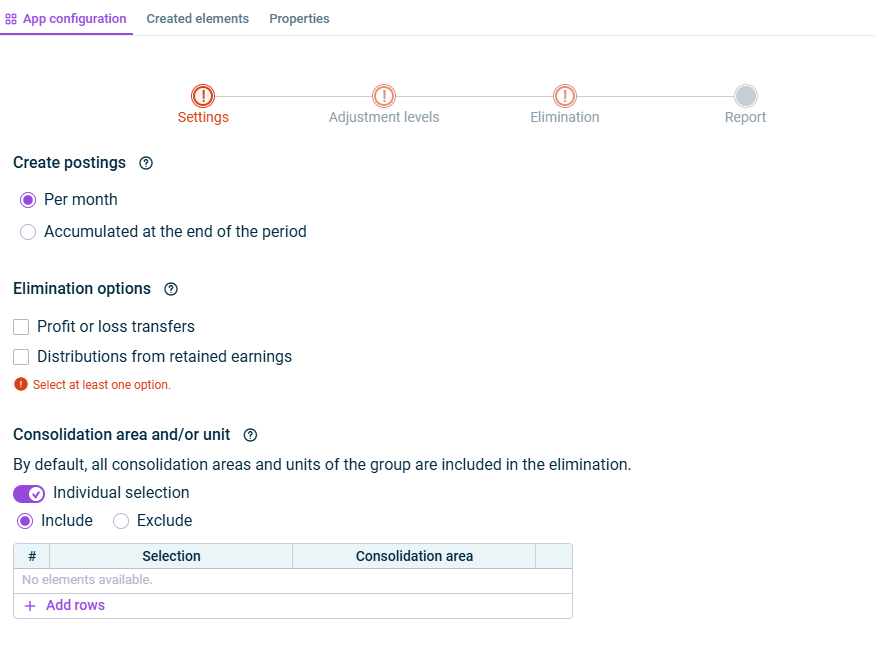

In the Settings step, specify the general settings for the configuration:

Option

Description

Create postings

- Per month

The app eliminates intercompany transactions in each month of the consolidation period and creates monthly elimination postings. - Accumulated at the end of the period

The app cumulatively eliminates intercompany transactions in the last month of the consolidation period and creates an accumulated elimination posting only in the last month of the consolidation period.

For any consolidation unit deconsolidated in the consolidation period, an accumulated elimination will be performed in the last month of the consolidation unit's inclusion in the consolidation area.

Elimination options

- Profit or loss transfers

To eliminate profit or loss transfers between investment and investor in the same period - Distributions from retained earnings

To eliminate distributions from retained earnings in income and equity

Consolidation area and/or unit

The consolidation areas and/or units that the elimination is to be performed for.

By default all consolidation areas and units of the group are included.

If you only want to include certain consolidation areas and/or units, activate the Individual selection check box and select one of the following options:

- Include

In the table, select individual consolidation areas and/or units to be considered. - Exclude

In the table, select the consolidation areas and/or units that are to be excluded.

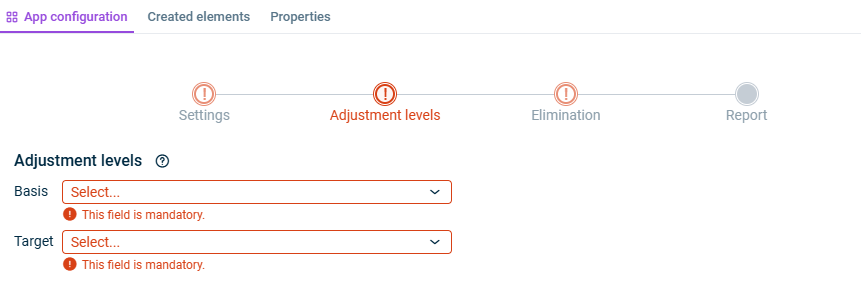

In the Adjustment levels step, specify the adjustment levels that should be taken into account for the elimination.

The app also carries out postings at adjustment levels that are locked for other postings.

Option

Description

Basis

Adjustment level group including all non-consolidation adjustment levels for data imports and postings you want to include in the elimination.

Please ensure that the adjustment level for proportioning is included in the adjustment level group.

Target

Adjustment level for consolidation postings to be used for the postings.

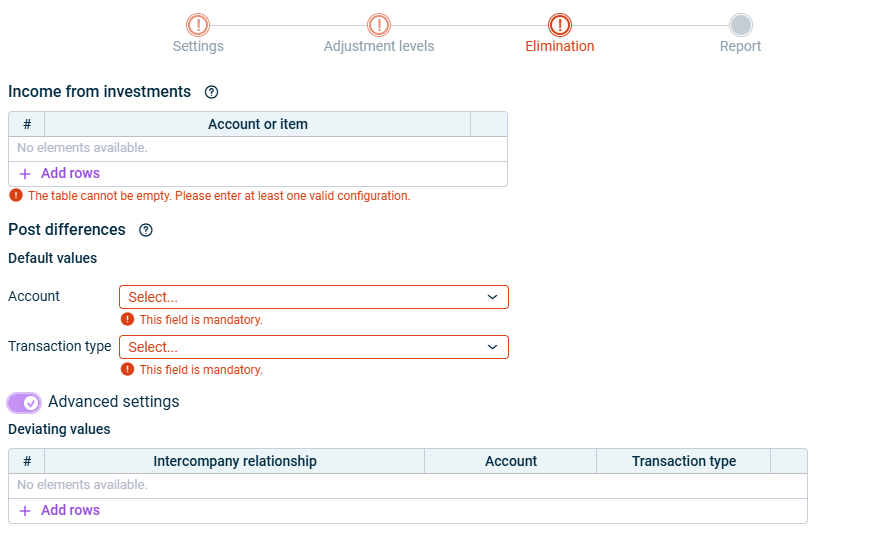

In the Elimination step, specify how to deal with income from investments.

Option

Description

Income from investments

The investor's accounts and/or items for eliminating income from distributions or profit/loss transfers received

Post differences

Account and transaction type for posting elimination differences

The account itself may not contain intercompany transactions to be eliminated.

Advanced settings

Deviating values

If you want to define different accounts or transaction types for certain intercompany relationships, activate the option Advanced settings.

After that, in the Intercompany relationship column, select the two related companies for which you want to define different values and configure a deviating account and/or a deviating transaction type.

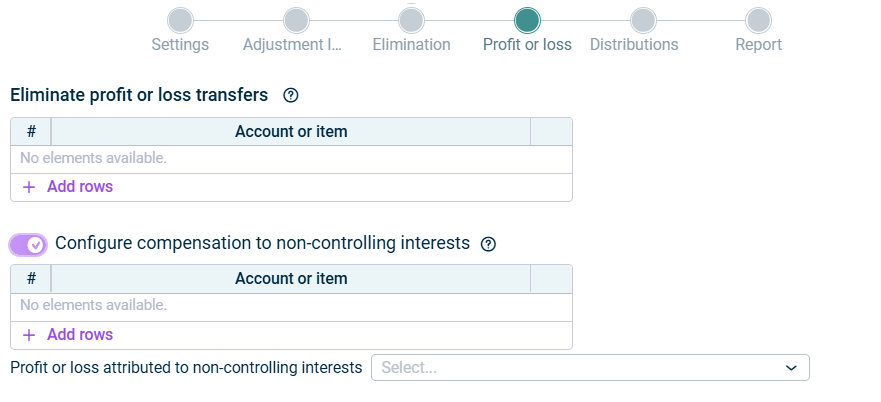

The Profit or loss step is only displayed if you chose Profit or loss transfers as elimination option in the Settings step:

Configure the following details for the elimination of profit or loss transfers:

Option

Description

Eliminate profit or loss transfers

Accounts and/or items of the investment that contain the amounts of the profit or loss transferred to be eliminated

Configure compensation to non-controlling interests

Compensation payments recognized on the chosen accounts and/or items will be reclassified to profit or loss attributable to non-controlling interests in the statement of profit or loss.

Profit or loss attributable to non-controlling interests

Account that the profit or loss from non-controlling interests is to be posted to

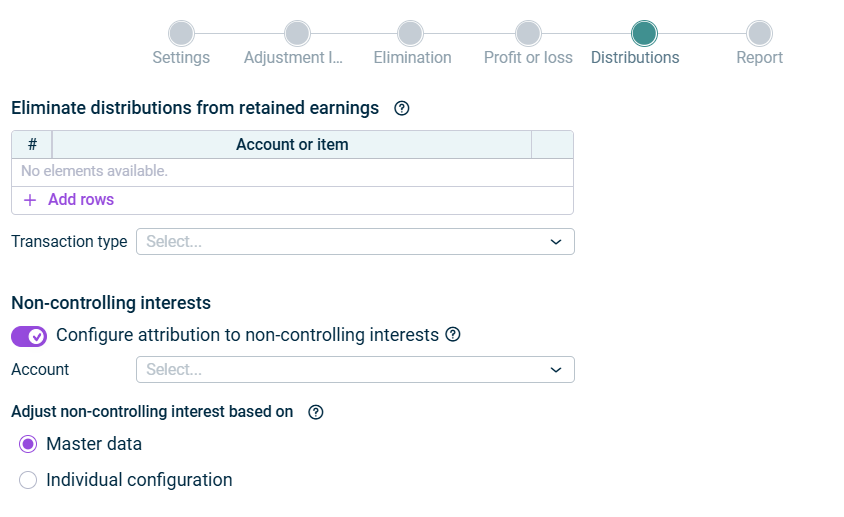

The Distributions step is only displayed if you chose Distributions from retained earnings as elimination option in the Settings step:

Configure the following details for the elimination of distributions from retained earnings:

Option

Description

Eliminate distributions from retained earnings

- The investment's accounts and/or items in equity

- Transaction type on which distributions are posted. Only distributions posted on this transaction type will be eliminated.

Non-controlling interests

Adjust non-controlling interest based on

- Master data

If you choose this option, the ownership interests defined in the master data administration will be used to calculate the adjustment of non-controlling interests. - Individual configuration

If you choose this option, an individually configured percentage value or an absolute amount will be used for the adjustment of non-controlling interests.

Use the displayed table to specify the share of distribution that will be attributed to non-controlling interests per investment.

For all other investments that are not configured in this table, the ownership interests defined in the master data administration will be used.

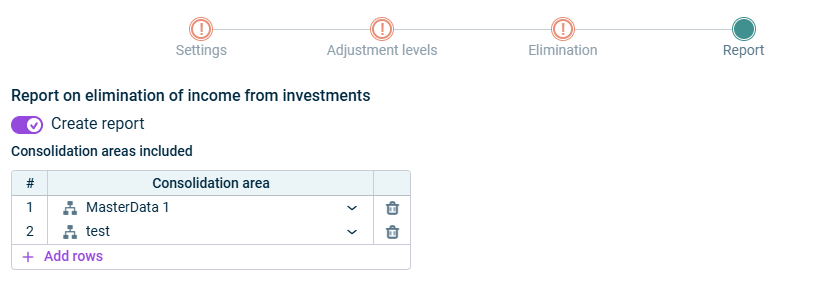

In the Report step, enter the consolidation area(s) that a report on the elimination of income from investments is to be created for, if necessary. The report shows the created elimination postings with any differences and the reclassifications to non-controlling interests.

Option

Description

Create report

Activate the option to create a report on the difference amounts when executing the app.

Consolidation areas included

Consolidation areas for which the report should be generated

The report can only be created for consolidation areas that were included in the Settings step for the app execution.

- As long as a step has not been fully configured and/or configuration errors exist, it is displayed with a red exclamation mark

.

. - Once a step is configured completely and without any errors, it is displayed with a green check mark

.

. - You can close the configuration dialog by clicking the arrow icon

at the top left.

at the top left. - To change the name of the app, select the app in the tree view and choose Properties from the context menu.

Executing the Elimination of Income from Investments

You can execute the app for the Elimination of income from investments either separately, together with other apps in an executable folder or as part of consolidated financial statements.

How to proceed in each case is described under Execute consolidation.

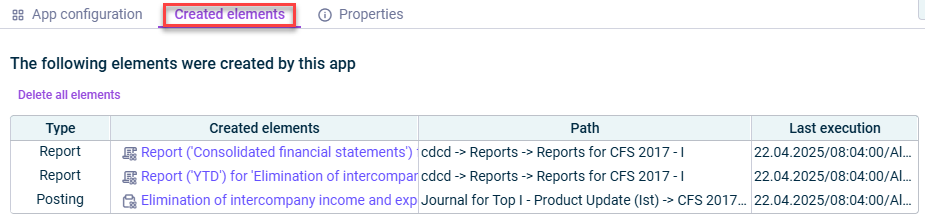

Displaying and Deleting Created Elements

On the Created elements tab, the postings that were created during the app execution are shown.

The table provides the following information:

- Type of the element

- Path under which the element was created When you click on the link, you are taken directly to the posting in the relevant journal or to the report.

- Date of the last execution that created the element

Note: Once all elements have been deleted, the state of the wizard is Not executed again.

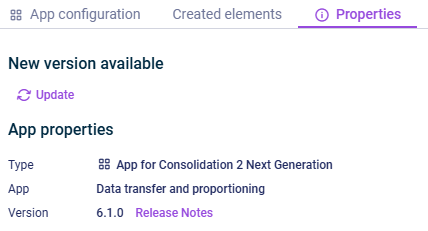

Displaying the App Properties

The App properties are displayed on the tab of the same name :

- Type of the element

- Function of the App

- Version of the element.

New available version

As soon as a new version of the app is available that contains changes to the app configuration and/or the calculation logic of the app, the Refresh command is displayed, allowing you to update the app to the latest version.

Information about the changes to each version can be found in the Release Notes, which can be accessed via the link of the same name.

We strongly recommend to update all apps to the new version as soon as possible because it cannot be guaranteed how long an app with an obsolete version can be executed.