Creating and Configuring Loan Wizards

Last updated on 2025-12-05

Overview

The Loan planning wizard allows both received loans and issued loans to be defined for reporting entities.

Lucanet regards a received loan as borrowing from outside or inside your company. An issued loan is regarded as loan issuance. Received and issued loans can be defined for different loan types.

The wizard can be created for all reporting entities for values of ledgers and schedules in planning data levels, either within a journal or from a ledger.

Notes on internal company loans

- If you have defined an internal company loan, all configuration settings of the selected, i.e. drawn-down, loan are transferred to the new loan.

- Internal company loans cannot be copied or transferred to journals with another data level. Alternatively, you can create a new planning data level based on the data level containing the loan in order to transfer the loan to another data level.

- When deleting, internal company loans are not deleted on both sides, i.e. on the borrower and the lender side but only on the side where the loan element was deleted, i.e. on the borrower or the lender side.

- An intercompany issued loan can only have one corresponding received loan configured in the database.

This article contains the following sections:

Creating a Loan Wizard Within a Journal

To create a loan wizard within a journal:

- Open the Journals workspace.

- In the dimension bar, select the combination of a planning data level and reporting entity for which a loan should be created.

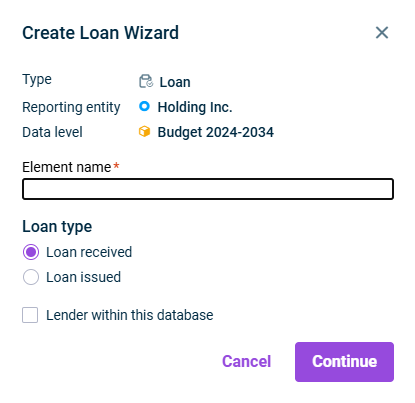

- Right-click the root folder and choose Create | Loan from the context menu. The Create Loan Wizard dialog is displayed:

Creating a loan wizard - Specify the name of the element.

- Select the loan type:

- Loan issued: if you want to define a loan issuance in which the reporting entity should function as a lender for another reporting entity, for example.

- Loan received: if you want to define a borrowing. Proceed as follows if an internal company loan is to be defined, i.e. the lender is not an external institution such as a bank, but is another reporting entity:

- Activate the check box Lender within this database.

- In the Lender drop-down list, select the reporting entity which is functioning as the lender.

- In the Loan drop-down list, select the loan that should be drawn down. The drop-down list displays all loans that have been defined as Loans issued to the selected reporting entity.

Creating a Loan Wizard From a Ledger

To create a loan wizard from a ledger:

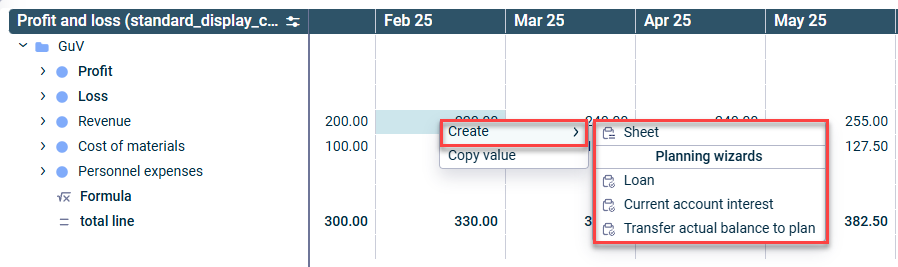

- Open the Reporting and analyzing workspace.

- Select the desired ledger (general ledger, sub-ledger or statistical ledger).

- In the dimension bar, select the combination of planning data level and reporting entity for which the wizard should be created.

- Right-click in the row of the ledger hierarchy for which a sheet should be created and choose Create | Loan.

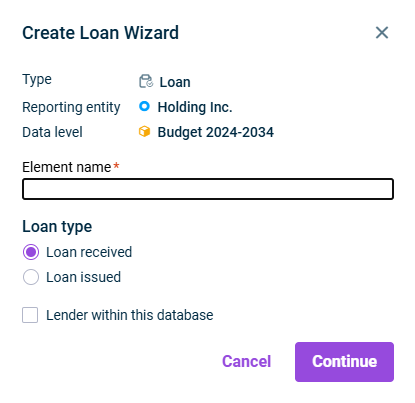

Creating a wizard from a ledger - The Create Loan Wizard dialog is displayed:

- Specify the name of the element.

- Select the loan type:

- Loan issued: if you want to define a loan issuance in which the reporting entity should function as a lender for another reporting entity, for example.

- Loan received: if you want to define a borrowing. Proceed as follows if an internal company loan is to be defined, i.e. the lender is not an external institution such as a bank, but is another reporting entity:

- Activate the check box Lender within this database.

- In the Lender drop-down list, select the reporting entity which is functioning as the lender.

- In the Loan drop-down list, select the loan that should be drawn down. The drop-down list displays all loans that have been defined as Loans issued to the selected reporting entity.

Configuring a Loan Wizard

To configure a loan wizard, click the name of the desired element in the tree view, and then click Edit in the top right. The configuration is divided into general properties in the header and four configuration steps in the main section of the editing mode.

The following properties can be configured in the header:

Property

Description

Element name

Name of the wizard

Cost center

Cost center in which the posting is to be performed by the planning wizard

Currency

Currency in which the posting is to be performed by the planning wizard

Adjustment level

Adjustment level in which the posting is to be performed by the planning wizard

The following options can be configured in the Master data step:

Option

Description

Lender/ Borrower

If a lender was selected from the database, the field is automatically populated with the lender and loan name and is set to read-only.

Otherwise, the field remains blank and editable.

Repayment type

Drop-down menu with two options as loan types:

- Annutiy loan: Select this type if a loan should be defined with a constant repayment amount (installment). The installment is the sum of the redemption and interest portions. In contrast to the installment loan type, the amount of the installment to be paid (annuity) remains the same over the entire duration (if a fixed interest period was agreed throughout the entire term).

- Installment loan: Select this type if a loan should be defined with a constant repayment portion. The repayment amount decreases continuously over the entire term (if a fixed interest period was agreed throughout the entire term).

Loan amount

Specify what (nominal) amount (without fees/debt discount) should be issued or received.

If Loan issued/Loan received was selected in the creation step without activating the Lender within this database checkbox, the field is pre-populated with '10.000,00' is editable.

If Loan received was selected in the creation step and the Lender within this database was activated, the field is pre-populated with the selected loan amount and is not editable.

Remaining debt

Amount which should have to be paid as remaining debt at the end of the loan term

Date of borrowing

Expected date of borrowing

If the borrowing period is before the planning period, i.e. in the Actual data level, this date can be entered and the software automatically calculates the remaining debt in the plan. In this way, it is possible to plan the continuation of already existing loans.

Loan term in months

Specify the term in months

Month of last installment

Specify the last month of the loan term

Method of interest calculation

The following calculation methods are available:

- 30/360 (German method)

In the German (commercial) method, each interest month is assumed to have 30 days, and each interest year 360 days. Interest is charged on either the first investment day or the last. - Act/360 (French method)

In the day-count convention (or the French interest method), the interest days are calculated exactly according to the calendar, and the base year is assumed to have 360 days. In the day-count convention, interest is charged on the first investment day but not on the last; in the French interest method, interest is charged on the last investment day but not on the first. - Act/365 (English method)

In the English interest method, the interest days are calculated exactly according to the calendar, which means the interest year has 365 or 366 days. The base year is assumed to have 365 days. Interest is charged on the last investment day but not on the first. - Act/Act (method based on the actual number of days)

In the effective interest method or the interest method based on the exact number of days, the interest days, interest year and base year are determined exactly according to the calendar. In this method, interest is not charged on the first investment day but on the last.

Additional options

Activate the check box for every additional option that you would like to configure for the loan. The following options are available:

- Commitment interest - frequently charged by banks for medium or long-term bank loans

- Fees - Lucanet does not regard fees for a loan as being the total amount of all interest and thus normal interest payments, but rather special services.

- Unscheduled repayments - that go beyond the current installments agreed in the loan contract

- Subsequent borrowing - increasing the loan amount during the loan term

Once activated, the corresponding step will be displayed on the user interface.

Current Installment

Option

Description

From/To

- From: Date of borrowing or Date of loan issuance

- To: Month of last installment

Pay installment

- The list contains 3 folders — Individual, Once per calendar quarter, Once per calendar year — each providing different configuration options.

- Choose No under Individual if there should be neither redemption nor interest payments during the loan term.

Installment includes repayment

- Only with Annuity loan type

- Deactivate the check box if only interest should be paid with each installment.

Annuity

- Only with Annuity loan type

- Specify the repayment amount per installment

Add row

Add additional rows if the payment modalities should be different for one or more time periods of the payment period.

Last installment repays the loan

Activate if the remaining debt existing at the end of the loan term should be repaid with the last installment, irrespective of its value.

If a value greater than zero was specified in the Remaining debt at the end of loan term field of the Master data tab, the Last installment repays the loan option is displayed at this item. Activate the check box if the outstanding repayment amount should be repaid down to the defined remaining debt with the last installment.

Value date of repayment

- Only with Installment loan type

- Select the day in the month on which the repayment should be posted

Repayment portion

- Only with Installment loan type

- Enter the repayment amount

- Keep the Without repayment default setting if the repayment should not take place using the current installment.

Interest

Option

Description

From/To

- From: Date of borrowing or Date of loan issuance

- To: Month of last installment

Interest rate (%)

- Enter the desired interest rate.

- Add additional rows if the interest rate should be different for one or more time periods of the payment period.

Calculation basis for values

The following options are available:

- Calculate interest based on the exact to the day remaining debt

- Calculate interest based on the remaining debt at the end of the month

- Calculate interest based on the remaining debt at the start of the month

Take interest on interest into account

The following options are available:

- No, accrue calculated interest until the repayment

- Yes, add the calculated interest to the payment of the remaining debt

These options are only available when Pay installment field is populated with any value except for Every month.

The following options can be configured in the Commitment interest step:

Duration

Option

Description

From/To

Until the day before borrowing/

The day before loan issuance

Interest rate and interest payment

Option

Description

From/To

Interest rate (%)

Applicable interest rate

Pay interest

When the interest should be paid:

- You can select a date of payment on a monthly, quarterly or annual basis.

- Choose No if there should not be any interest payments.

Calculation basis for values

Amount the interest calculation is based on

Initial loan amount

Activate the check box to transfer the value that is defined as the Loan amount in the Master data step.

Configuration of fees in a loan

Configuration of fees in a loan

The following options can be configured in the Fees step:

Option

Description

Date

Fee

Amount of the fee

In % of the loan amount

Percentage of the loan amount

Add fees to remaining debt

Activate the check box if the fees should be added to the remaining debt.

Presentation in P&L

How the fees should be shown in the P&L. Choose one of the following options:

- Present interest for each month if the fees should be presented evenly distributed in each month of the loan term

- Present interest only in the payment month if the fees should only be presented in the month of the payment.

Configuration of unscheduled repayments in a loan

Configuration of unscheduled repayments in a loan

The following options can be configured in the Unscheduled repayments step:

Option

Description

Date

Amount

Amount of the unscheduled repayment

In % of the loan amount

Percentage of the loan amount

Configuration of subsequent borrowings in a loan

Configuration of subsequent borrowings in a loan

The following options can be configured in the Subsequent borrowing step:

Option

Description

Date

Date when the subsequent amount is borrowed or lent

Amount

Amount of the subsequent borrowing

In % of the loan amount

Percentage of the loan amount

In the Posting step, the affected accounts can be specified:

- For each row, select the desired account from the drop-down list.

- If applicable, select the desired partner from the drop-down list. The partner field is pre-populated with a default partner.

The following accounts must be specified, depending on the options you configured for the wizard:

Option

Description

Loan account

Liabilities account for the borrowing.

This account is selected right from when the loan is created, but can be changed at any time in the configuration.

Contra account for borrowing

Bank account for the borrowing/loan issuance

Contra account for ongoing redemption

Bank account from which the redemption is deducted

Current interest (bank account)

Bank account from which the current interest is taken

Current interest (P&L account)

Expense account to which the interest expenses are posted

Fees (Bank account)

Bank account from which the fees are taken

Fees (P&L account)

Expense account to which the fees are posted

Accrual account for interest and fees

Accruals and deferrals account for the period-specific accrual and deferral of the interest and fees

Commitment interest (Bank account)

Bank account from which the commitment interest is taken

Commitment interest (P&L account)

Expense account to which the commitment interest is posted

Unscheduled repayments

Bank account from which the unscheduled repayments are deducted

In the last step, a summary of the calculated payments and interest amounts for the entire loan duration is displayed.

If the loan dates fall outside the date range of the Planning data level (e.g., a loan starts before the start date or ends after the end date of the Planning data level), the summary table will indicate this by greying out the respective periods.