FTE & PE Allocations

Last updated on 2025-07-21

Overview

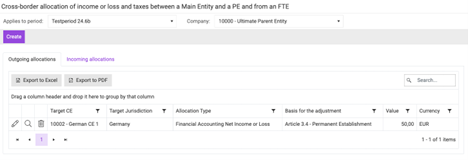

In the FTE & PE Allocations workspace, you can manage cross-border allocations of income or loss and taxes between a parent entity and its permanent establishment (PE) or a flow-through entity (FTE). The interface enables you to view both Outgoing allocations and Incoming allocations, providing flexibility in managing financial movements. It also supports exporting allocation data as an Excel or pdf file for reporting and analysis. Additionally, the Pillar 2 module includes filtering and search functionalities to manage and organize data efficiently.

This article contains the following sections:

Navigation

The FTE & PE Allocations workspace can be found at Pillar 2 | Entity Data Collection | FTE & PE Allocations. The workspace is displayed as follows, for example:

'FTE & PE Allocations' workspace

'FTE & PE Allocations' workspace

Note: The effect an allocation has on the CE calculations depends on the adjustment type:

- Financial accounting net income or loss adjustments are considered in fields INC-1.2 and INC-1.3.

- Current taxes adjustments are considered in fields CT-1.2 and CT-1.3.

Creating New Allocations

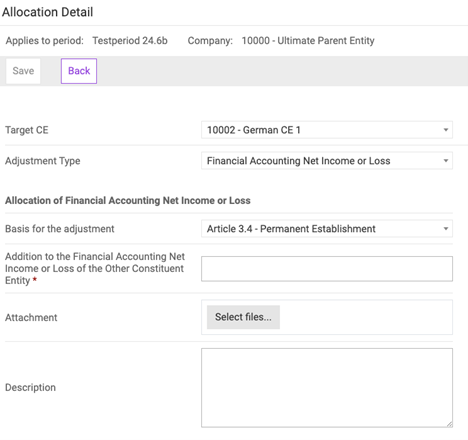

In addition to importing allocations, you also have the option to manually create new allocations. To create a new FTE or PE allocation:

- Select a period from the Applies to period drop-down menu.

- Select the source CE from the Company drop-down menu.

- Click Create.

- Select the following:

- Target CE.

- An adjustment type:

- Financial accounting net income or loss

- Current taxes (FTE or PE).

- Select the legal basis for the adjustment:

- For a financial accounting income or loss adjustment:

- Article 3.4 - Permanent establishment;

- Article 3.5.3 - Other owners that are not group entities (flow-through);

- Article 3.5.1 (a) - Permanent Establishment (flow-through);

- Article 3.5.1 (b) CE-owner (flow-through).

- For a current taxes (FTE or PE) adjustment:

- Article 4.3.2 (a) - Permanent Establishment;

- Article 4.3.2 (b) - Tax transparent entity;

- Article 4.3.2 (d) - Hybrid entity;

- Article 4.3.4 - Loss making permanent establishment.

- For a financial accounting income or loss adjustment:

- Enter the amount for the addition to the covered taxes of the other constituent entity in the local currency of the source CE.

- Click Save.

Editing Existing Allocations

To edit an existing tax allocation:

- Select a period from the Applies to period dropdown menu.

- Select the source CE from the Company dropdown menu.

- Click the edit button (the little pencil) next to the allocation.

- Select an adjustment type:

- Financial accounting net income or loss;

- Current taxes (FTE or PE).

- Select the legal basis for the adjustment:

- For a financial accounting income or loss adjustment:

- Article 3.4 - Permanent establishment;

- Article 3.5.3 - Other owners that are not group entities (flow-through);

- Article 3.5.1 (a) - Permanent Establishment (flow-through);

- Article 3.5.1 (b) CE-owner (flow-through).

- For a current taxes (FTE or PE) adjustment:

- Article 4.3.2 (a) - Permanent Establishment;

- Article 4.3.2 (b) - Tax transparent entity;

- Article 4.3.2 (d) - Hybrid entity;

- Article 4.3.4 - Loss making permanent establishment.

- For a financial accounting income or loss adjustment:

- Enter the amount for the addition to the covered taxes of the other constituent entity in the local currency of the source CE.

- Click Save.

Notes:

- Optionally, you can upload supporting documents as an attachment to the allocation or add a description, e.g. a comment that explains divergences from prior years.

- Allocations use the local currency of the source CE.

- The Incoming allocations tab is purely informational. Entering new allocations or editing existing allocations must be done outgoing from the source CE.