Additional Accounting Rule Options

Last updated on 2025-07-02

Overview

The additional accounting rule options allow you to streamline your accounting configurations by using rules from superordinate elements, applying rules across different journals without recreating them, and efficiently organizing or removing rules within a journal. These features help save time, reduce duplication of work, and ensure consistency across your financial data.

This article contains the following sections:

Using Superordinate Configurations

Items and accounts can be configured so the accounting rule of the parent ledger, folder, or superordinate item applies. This is suitable, for example, if the rule applies to the majority of the subordinate items or accounts. Deviations from the superordinate accounting rule can be configured in the subordinate accounts or items.

To use the accounting rule of the parent ledger, folder, or superordinate item:

- In the tree view, select the account or item for which the superordinate configuration should apply.

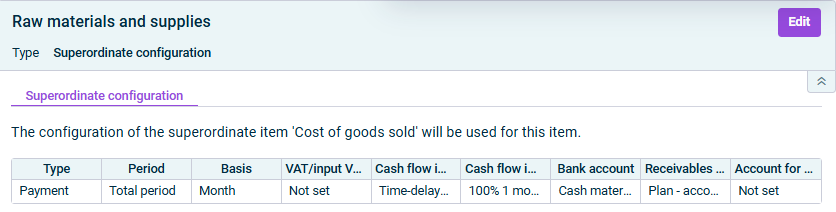

- In the Type drop-down list, select the Superordinate configuration type. The detail view is displayed as follows, for example:

Detail view of a superordinate configuration

Applying Accounting Rules to Other Journals

The rules for automatic contra entries always apply to a journal, i.e. a particular combination of data level and reporting entity. To avoid creating a new configuration for each journal, you can copy the rules if they also apply to other journals. It is possible to adopt all saved accounting rules from general ledgers and subledgers or individual accounting rules from folders, items or accounts.

To apply accounting rules to other journals:

- In the tree view, select the general ledger and/or one or more subledgers, folders, items or accounts whose accounting rule(s) you want to transfer to other journals.

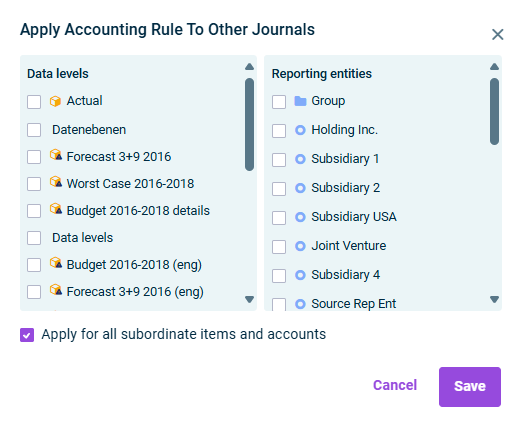

- Click Apply accounting rules to other journals in the dimension bar. The Apply Accounting Rules to Other Journals dialog is displayed:

'Apply accounting rule to other journals' dialog - Select the Data levels and the Reporting entities into which the accounting rules are to be transferred.

- If applicable, activate the Apply for all subordinate items and accounts check box to transfer not only the rules of the selected folder, item or account but also those of all subordinate items and accounts.

- Click Save.

Copying and Moving Accounting Rules Within a Journal

The accounting rules in a journal can be moved to other items or accounts in the journal using the mouse or keyboard.

To copy or move accounting rules:

- Select the account or item for which you want to copy or move the accounting rule.

- Choose Copy/Cut from the context menu.

- Select the accounts or items which you want to transfer the accounting rule to.

- Choose Paste from the context menu.

Deleting Accounting Rule Configurations

The accounting rule configurations in a journal (combination of data level and reporting entity) can be deleted if they are not being used in any postings — or if the associated postings are deleted first.

To delete an accounting rule configuration:

- Select the accounts or the item for which you want to delete the accounting rule configuration.

- Right-click the marked accounts or items.

- Choose Delete from the context menu.

The superordinate configuration is automatically allocated to the selected accounts and items.