General Functions

Last updated on 2025-07-17

Overview

In Income Taxes, various common functions are available to you in the workspaces, for example, to increase the clarity of tables or to display detailed information on data origin, among other things.

This article describes these functions.

This article contains the following sections:

Standard Functions of Income Taxes

The following functions are generally available in the workspaces of Income Taxes:

Option

Description

Save

Saves the actual data of the workspace.

![]()

Opens a data set in editing mode.

![]()

Opens a data set in read-only mode.

![]()

Deletes or archives a data set.

![]()

Restores an archived data set.

![]()

Displays detailed information about the calculation and/or the data origin of a row.

![]()

Displays information about the respective option in workspaces.

![]()

Comments are stored and can be opened and/or edited using this button.

Comments

Opens the entry in editing mode.

Export as Excel/Export as PDF

Exports the workspace to an Excel spreadsheet or PDF document.

Entering Values

Two options are available for entering values in a form:

- Enter the desired amount directly into the corresponding input field.

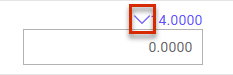

- Apply the Proposed value displayed above the Input field by clicking the downward-pointing arrow in front of the amount.

Applying proposed value

Applying proposed value

Sorting and Filtering Data Sets

The data sets shown in the individual workspaces are displayed in many places in a tabular overview (e.g. list of created companies in the Master data dialog Companies). The data sets in the overview can be sorted in the columns. To do this, click the entry in the column header and use the arrows that are then displayed:

- Up arrow: ascending sort

- Down arrow: descending sort

To filter the displayed data sets, you can use the Filter function. Proceed as follows:

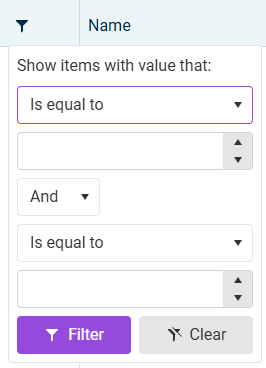

- Click the Filter icon in the heading of the respective column. The following dialog is displayed:

Filtering values in tables - Enter the search term and, if necessary, use the displayed options to narrow down the search term.

- Confirm your input with Enter.

- If necessary, click Delete to reset a filter.

Setting the Number Format

The notation of numbers is defined in the Number Format selection menu. The number format determines how the input and output of numbers should be handled in Income Taxes. This function is necessary because different number formats are used internationally. In Germany, for example, it is common to use a comma to separate whole numbers and decimal places, and a period as the thousands delimiter (e.g., 1.000.000,00). In the USA, it is exactly the opposite (e.g., 1,000,000.00).

The user can therefore individually select one of four internationally common number formats. This ensures that the Income Taxes Reports can be used without Excel reformatting. The format setting is made in the CFO Solution Platform under My profile | Change formatting preferences (see Basic Configuration for the Lucanet CFO Solution Platform).