Creating and Configuring Current Account Interests

Last updated on 2025-12-09

Overview

The wizard for the current account interest can be used in Lucanet to plan the automatic interest return of giro accounts and overdraft facilities.

The wizard can be created for all reporting entities for values of ledgers and schedules in planning data levels, either within a journal or from a ledger.

Creating a Current Account Interest Within a Journal

To create a current account interest within a journal:

- Open the Journal's workspace.

- In the dimension bar, select the combination of a planning data level and reporting entity for which a current account interest wizard should be created.

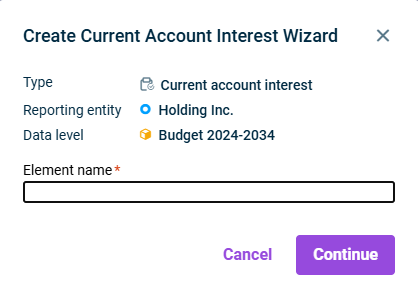

- Right-click the root folder and choose Create | Current account interest from the context menu. The Create Current Account Interest Wizard dialog is displayed:

Creating a current account interest wizard - Specify the name of the element and click Continue.

Creating a Current Account Interest From a Ledger

To create a current account interest from a ledger:

- Open the Reporting and analyzing workspace.

- Select the desired ledger (general ledger, sub-ledger or statistical ledger).

- In the dimension bar, select the combination of planning data level and reporting entity for which the wizard should be created.

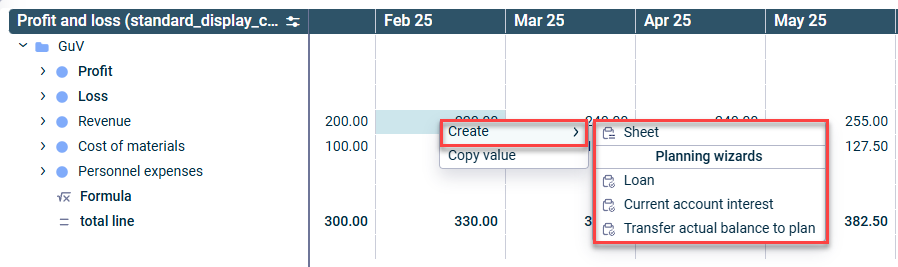

- Right-click in the row of the ledger hierarchy for which a sheet should be created and choose Create | Current acount interest.

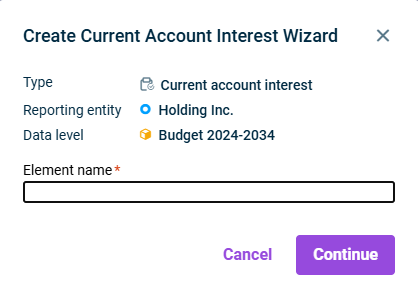

Creating a wizard from a ledger - The Create Current Account Interest Wizard dialog is displayed:

Creating a current account interest wizard - Specify the name of the element and click Continue.

Configuring a Current Account Interest

To configure a current account interest, click the name of the desired element in the tree view, and then click Edit in the top right. The configuration is divided into general properties in the header and three configuration steps in the main section of the editing mode.

The following properties can be configured in the header:

Property

Description

Element name

Name of the wizard

Cost center

Cost center in which the posting is to be performed by the planning wizard

Currency

Currency in which the posting is to be performed by the planning wizard

Adjustment level

Adjustment level in which the posting is to be performed by the planning wizard

Basis

Adjustment level (group) used as the planning basis

The following options can be configured in the Master data step:

Calculation basis

Option

Description

Account or item

Accounts and/or items that should be taken into account when calculating the interest expense or interest income

Balance option

Balance to be used as the calculation basis. The following options are available:

- Balance at start of month

- Balance at end of month

- Average balance of the month

Interest

Option

Description

Interest rate table

- If the interest rate is always the same irrespective of the account balance, specify the desired interest rate.

- If the interest rate is dependent on the account balance, i.e. if different interest rates apply to different account balances:

- Click the Interest rate (%) column and specify the desired interest rate.

- Click + Add row.

- Enter the value up to which the specified interest rate applies in the original row in the To (exclusive) column.

The value is transferred to the new row as the starting value for the value range. - In the new row, click the Interest rate (%) row and specify the desired interest rate.

- If applicable, add further rows and follow steps 2 to 4 in each case.

In the column Interest rate, you can also specify negative interest.

Calculate interest per value range

Activate, if the interest should be calculated for each value range. In this case, the interest is based on the value of the calculation basis per value range and the interest rate of the respective value range.

If the check box is not activated, the interest is calculated on the total balance of the calculation basis with the interest rate of the value range within which the total balance is situated.

Interest credit option

Allows selecting when the interest credits should be posted. The following options are available:

- Every month

- Every last month of the calendar quarter

- Every last month of the calendar year

Presentation in P&L

Allows selecting when the interest expense/income should be posted to the ledger. The following options are available:

- Present interest expense or income in each month

- Only present interest expense/income in the month of the interest credit

This option is only available if Every last month of the calendar quarter or Every last month of the calendar year is selected from Select interest credit option.

Note on adding a new time period in the Interest table

If different interest rates apply to the same values for specific time periods in the planning data level, add and configure these periods as needed. Select +Add time period. In the New Time Period dialog, choose the first and last period for the time range with the deviating interest rates. The new period appears in the Interest table, where you can configure the interest rates as required.

In the Posting step, you specify the affected accounts.

If applicable, you can also select the desired partner from the drop-down list. The partner field is pre-populated with the default partner.

The following accounts must be specified:

Option

Description

Interest income (balance sheet account)

Balance sheet account to which the interest income is posted

Interest income (P&L account)

Income account on which the interest income is shown

Interest expense (balance sheet account)

Balance sheet account from which the interest payments are posted

If the check box is not activated, the interest is calculated on the total balance of the calculation basis with the interest rate of the value range within which the total balance is situated.

Interest expense (P&L account)

Expense account on which the interest expenses are shown

Accrual account for interest (Balance sheet account)

Balance sheet account to which the accrual for the interest is posted

This option is only available if Present interest expense/income in each month is selected from Presentation in P&L from the Master data step.

Troubleshooting for Invalid Configuration due to Subsequent Debit/Credit Shift Activation

The configuration of the Current account interest wizard may become invalid due to a wrong debit/credit shift setup.

The error arises when the Current account interest wizard has been set up for an account for which a debit/credit shift is activated subsequently in its superordinate item, and in case that the specified accounts for the interest income and interest expense are in the same item as the debit/credit shift that was set up subsequently.

In this case, the wizard is displayed with a red warning icon:

Shows a journal and the details of a current account interest wizard. Highlighted in red are the wizard element with the red warning icon and the command 'Show error description'

Shows a journal and the details of a current account interest wizard. Highlighted in red are the wizard element with the red warning icon and the command 'Show error description'

To see the details of the error, click the command Show error description in the detail view of the wizard. The following message is displayed:

To fix the error, you can do one of the following:

- Deactivate the debit/credit shift for the respective account.

- Include the opposite side of the debit/credit shift account to the wizard's calculation basis.

- Change the accounts used for posting the interest income and interest expense.