Creating and Configuring Asset Classes

Last updated on 2025-01-02

Overview

An asset class is a group of assets that have similar characteristics and are subject to the same accounting treatment. This classification helps to make the structuring and management of lease components more efficient. Different asset classes can have different effects on financial indicators. For instance, buildings may have a longer depreciation period than vehicles.

To provide a basis for accounting for leases, asset classes are created and edited in the workspace of the same name.

This article contains the following sections:

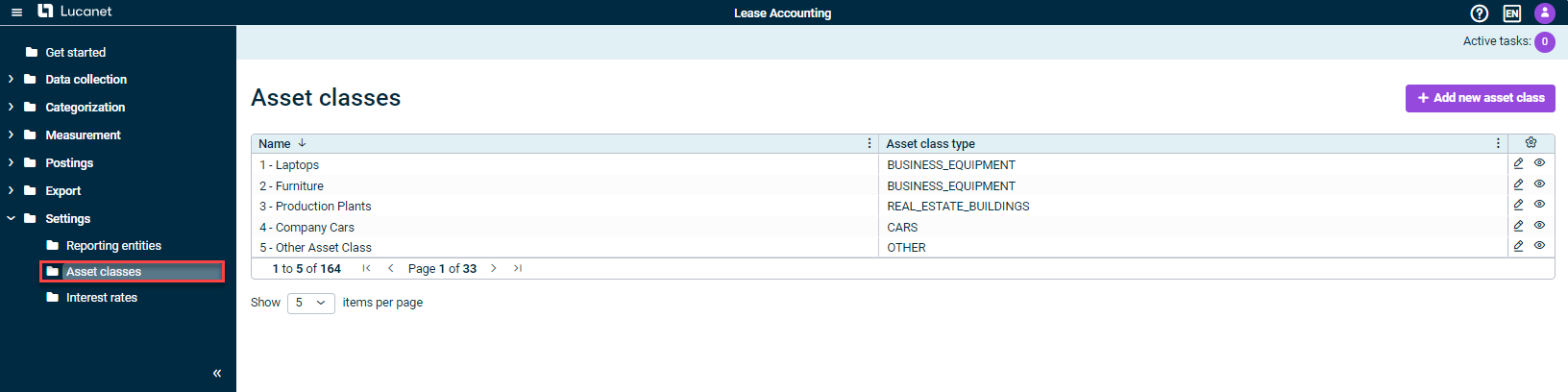

The ‘Asset Classes’ Workspace

The Asset classes workspace displays all the asset classes that have already been created:

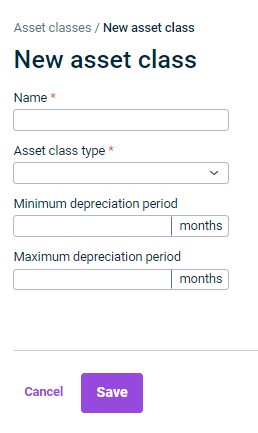

Configuring an Asset Class

When configuring an asset class, the following options are available:

Fields marked with a * are mandatory fields.

Option

Description

Name

Asset class name

Asset class type

Type that is going to be assigned to the asset class

- The most common asset class types preconfigured in Lease Accounting are available for selection.

- You can select the required type in the drop-down list or search for it using the Search box.

Minimum depreciation period

Minimum depreciation period that will apply to the asset class, in months

Maximum depreciation period

Maximum depreciation period that will apply to the asset class, in months