Configuring Payments

Last updated on 2025-08-01

Overview

The Payment accounting rule type is used for all accounts and items relating to business transactions with a cash flow impact. The Payment type is the most frequently occurring rule in the P&L.

This article contains the following sections:

Configuring Payments

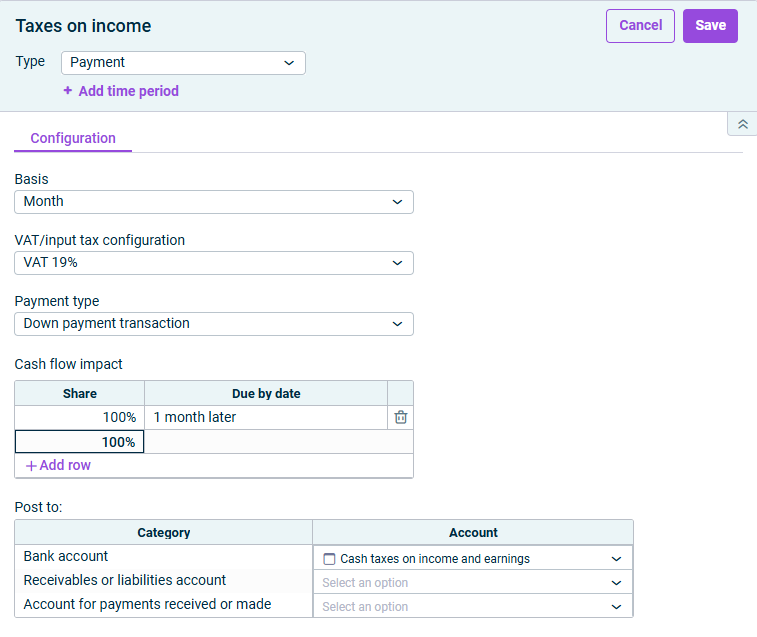

To configure an accounting rule of the type Payment:

- In the dimension bar, select the combination of data level and reporting entity for which the accounting rule should apply.

- In the tree view, select the desired element (subledger, account, item, or folder).

- Click Edit in the top right to open editing mode.

- If you selected a subledger, open the Transaction figure tab.

- Select Payment as the accounting rule from the Type drop-down list.

- Add or delete a time period, to, e.g., configure seasonal differences within a planning period.

Notes on the Add/Delete time period options:

- Newly added time periods are displayed on the Configuration tab.

When deleting a time period, the currently selected tab is always deleted.

Options on the Configuration Tab

The following options are available on the Configuration tab:

In the Basis drop-down list, select the periodicity for the payment calculation.

The available options vary depending on the starting month of the fiscal year.

If the fiscal year starts in January, the following options are available:

- Month, Quarter, Trimester, Semester.

If the fiscal year starts in any month other than January, the following options are available:

- Month, Quarter, Trimester, Semester, Calendar year, Quarter in the fiscal year, Trimester in the fiscal year, Semester in the fiscal year, Fiscal year.

Optionally, you can select a VAT/input tax configuration from the drop-down list (see VAT/input tax administration).

The following payment types are available:

Payment type

Description

With immediate cash flow impact

If the payment will be received or made within the same month

Time-delayed payment

If the incoming or outgoing payments are made at different times

Down payment transaction

If a down payment is required when the transaction is completed

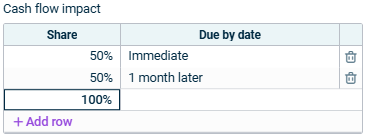

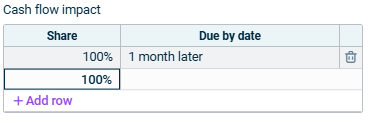

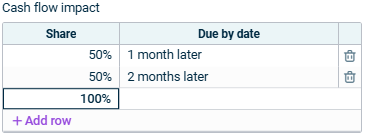

The Cash flow impact section is only visible if you selected Time-delayed payment or Down payment transaction from the payment type drop-down list.

Column

Configuration

Due by date:

Month basis

- Enter 0 for immediate payments.

- Enter a positive number for a subsequent payment, e.g. 2 = 2 months later.

- Enter a negative number for an earlier payment, e.g. -2 = 2 months earlier.

For an example of how average incoming payments can be entered on the Month basis, see Cash Flow Example.

Due by date:

Quarter, Trimester, Semester, Calendar Year basis

The column displays the due by date with the notation a+b or a-b.

- For a, enter the month of the date of payment, e.g. 4 for April.

- Specify the time offset for b. The time offset depends on what periodicity you have set. Proceed as follows:

- For a later payment, enter +, e.g. 4+2 = 4th month (April), 2 quarters, trimesters, semesters or calendar years later.

- For an earlier payment, enter -, e.g. 4-2 = 4th month (April), 2 quarters, trimesters, semesters or calendar years earlier.

Share

Enter what percentage of the outstanding receivable or liability will be paid by the specified date.

Cash Flow Example

Specify the accounts to which postings will be made in the Post to section.

The accounts to be specified depend on the chosen payment type.

Payment type

Description

With immediate cash flow impact

- Bank account: An account for the contra entry

Time-delayed payment

- Bank account: An account for the contra entry

- Receivables or liabilities account: An account to which the corresponding value is temporarily posted until the cash flow impact takes effect

Down payment transaction

- Bank account: An account for the contra entry

- Receivables or liabilities account: An account to which the corresponding value is temporarily posted until the cash flow impact takes effect

- Account for payments received or made: An account to which the down payment is temporarily posted until the service is provided.