Companies

Last updated on 2025-07-11

Overview

Most tax accounting standards only recognize legal and natural persons. However, Pillar 2 uses the concept of constituent entities (CEs) instead. Under these rules, permanent establishments are treated as if they were separate companies.

When used by an international tax module, the Companies workspace in the Master Data functional area is also used to store information on other CEs. In the following, the term company master data refers to any information stored in this section and not necessary to information pertaining to a company under any domestic law.

This article contains the following sections:

Importing Constituent Entities

Customers who have used other Tax Compliance & Reporting modules in the past or who for other reasons already have the relevant data on their companies in Tax Compliance & Reporting may want to simply add additional CEs manually at Master Data | Companies.

However, especially new customers and groups with a large number of permanent establishments might instead opt to import their company master data. To do so, please speak to your Lucanet contact to have an SQL script created to upload company master data. This requires customers to fill in a template to upload unit master data and one for the specific tab on international tax unit master data.

Viewing or Editing International Tax Master Data

To view or manually edit company master data:

- Navigate to Master Data | Companies.

- Click the edit button (pencil icon) on the left of the company’s unit ID.

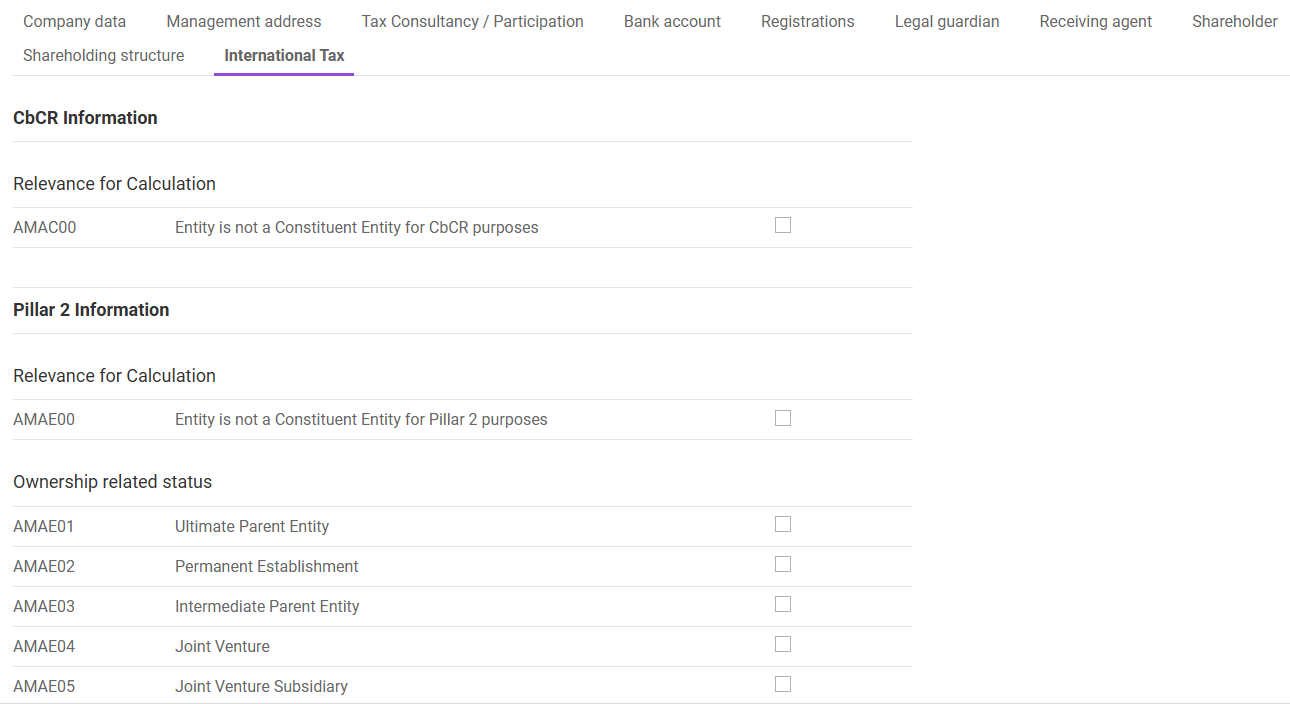

- Navigate to the International Tax tab to access Pillar 2-specific data.

'International tax' tab of a company

'International tax' tab of a company

While some of that data such as the status related to Tax Treatment is purely informational, other choices directly affect the calculations in the international tax modules, for example AMAC00 and AMAE00:

Option

Description

AMAC00

If this checkbox is activated for any given CE, that CE is not part of the CbCR calculations.

AMAE00

If this checkbox is activated for any given CE, that CE is not part of the Pillar 2 calculations.

Ownership-Related Status (AMAE01 - AMAE09)

This field is for informational purposes only.

Status Related to Potential Exclusion (Without Consideration of Election to Disregard Exclusion)

Each of the following elections confers excluded entity status on the respective CE. An excluded entity is listed in the calculations, but all its values are set to 0. However, selecting EE-4 at Pillar 2 | Entity Data Collection | OECD-Standard | Entity Election and General Information overrides AMAE20 to AMAE26 and strips a CE of its excluded entity status. Consequently, any values entered for that company will be part of the Pillar 2 calculations.

Status Related to Tax Treatment, Status related to Filing, Other Non-ownership Related Status Information

For informational purposes only.