Tax Compliance & Reporting

The Tax Compliance & Reporting solution provides a central and flexible platform for comprehensive tax management, helping companies efficiently fulfill their tax obligations while ensuring compliance. The solution optimizes every aspect of tax processes and provides an intelligent platform that manages the entire tax lifecycle. Tax Compliance & Reporting simplifies complex reporting requirements, minimizes risks, and provides the tax team with unparalleled control.

Modules

Tax Compliance & Reporting offers the following modules, which can be individually licensed:

Tax Administration

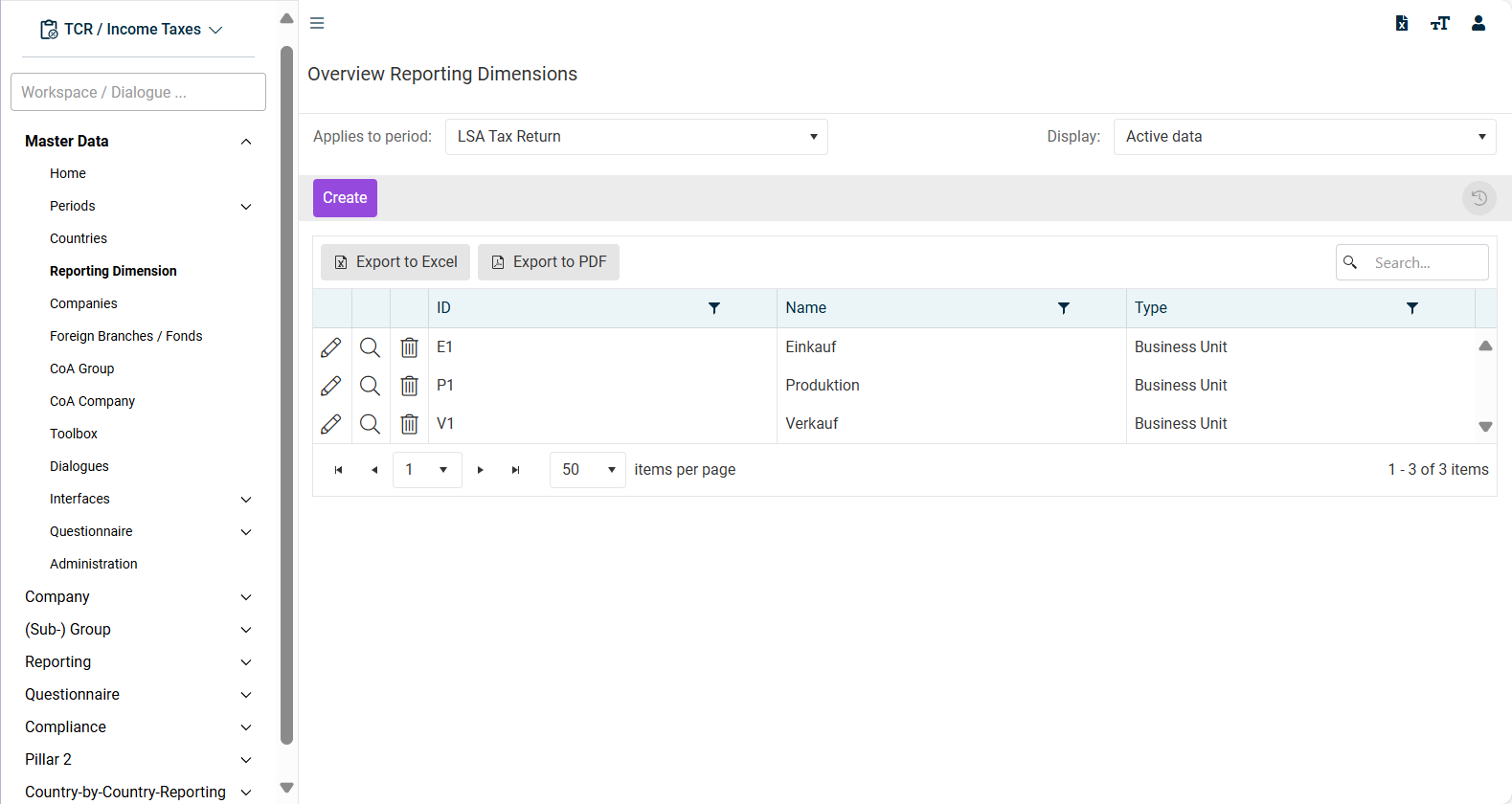

The Lucanet module Tax Administration provides global master data administration for your Tax Compliance & Reporting modules, including:

- Managing users or assigning roles to users

- Uploading and managing certificates, e.g. ELSTER certificates

- Designing email templates that are sent to users of Tax Compliance & Reporting in response to specific events

Income Taxes

The Lucanet module Income Taxes provides a central and flexible platform for comprehensive tax management, helping companies efficiently fulfill their tax obligations while ensuring compliance. The solution optimizes every aspect of tax processes and provides an intelligent platform that manages the entire tax lifecycle.

Income Taxes contains various sub-modules, which can be licensed individually and are reflected in the user interface as follows:

Tax Accounting serves as a central platform for the calculation of current and deferred taxes in the context of tax reporting under IAS 12. The system automatically generates the corresponding disclosures for the notes and thus optimizes the entire tax accounting process.

Tax Accounting offers the following benefits, among others:

- Automated tax calculation: Calculations of deferred and actual taxes in compliance with regulations and in accordance with IAS 12, IAS 34, and Section 274 of the German Commercial Code (HGB)

- Group-wide data consolidation: Aggregation and harmonization of tax data from all companies

- Workflow management: Real-time monitoring of progress and deadlines with integration into financial processes

- Multi-system integration: Direct connection to ERP systems, financial systems, and third-party tools

- Period-specific data separation: Clear distinction between reporting periods

- Flexible parameterization: Customizable company-specific settings

- Standardized compliance processes: Consistent procedures to minimize audit risks

- Complex tax structure management: Management of multi-layered tax group structures

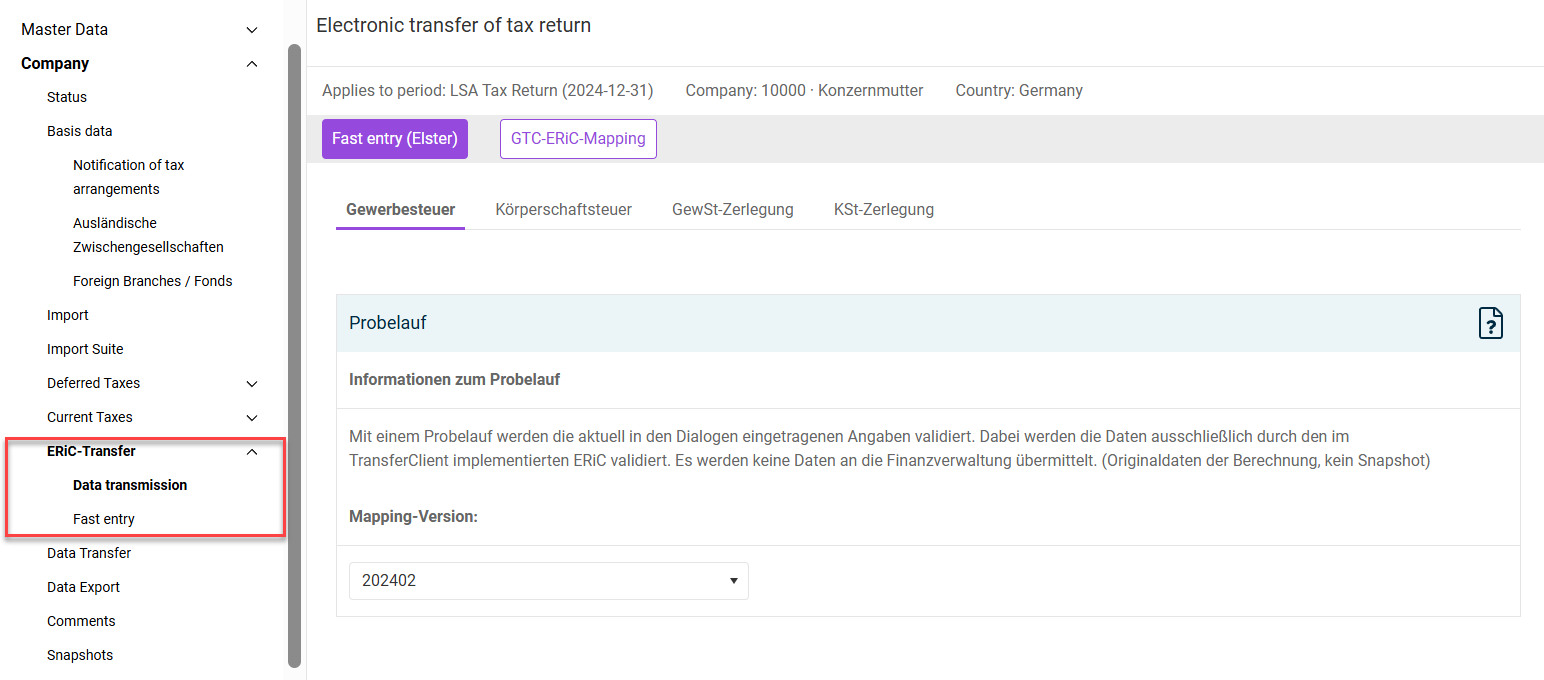

Tax Return offers a comprehensive solution for the preparation, management, and electronic filing of German tax returns in accordance with local tax regulations. The sub-module optimizes the entire tax return process from data collection to final submission to the German tax authorities, ensuring full compliance with all regulatory requirements.

- End-to-end tax reporting solution: Complete management from data collection to electronic transmission

- Electronic transmission: Direct transfer of trade and corporate income tax, as well as breakdowns, assessment notices, and related attachments to German authorities

- Compliance: Compliance with German regulatory requirements using validation functions

- Central master data administration: Uniform data administration at company level for consistent data processing

- Standardized transfer workflow: Guided processes for data entry, validation, approval, and final transfer

- Snapshot functionality: Complete audit trail through automatic backup and restore functions

- Seamless integration: Shared database with the Tax Accounting sub-module

- Data security and auditability: Protection of sensitive tax data with complete transmission history

The Pillar 2 sub-module supports the calculation, analysis, and reporting of global minimum tax obligations in accordance with the OECD’s Pillar 2 requirements. The module includes integrated data evaluations for Safe Harbour checks, CE calculations, de minimis assessments, jurisdictional blending, and allocation of top-up tax amounts. Rule-based calculations and scenario analyses enable a comprehensive understanding of effective tax rates, proactive risk mitigation, more efficient compliance, and strategic planning support for multinational corporations.

The Country-by-Country Reporting (CbCR) enables the automated collection, validation, and reporting of country-specific data in accordance with OECD guidelines and local regulations. The CbCR module includes features for data integration and audit workflows and provides ready-to-use reports. This allows for a comprehensive overview of global tax obligations, improved compliance, reduced manual effort, and increased audit readiness.

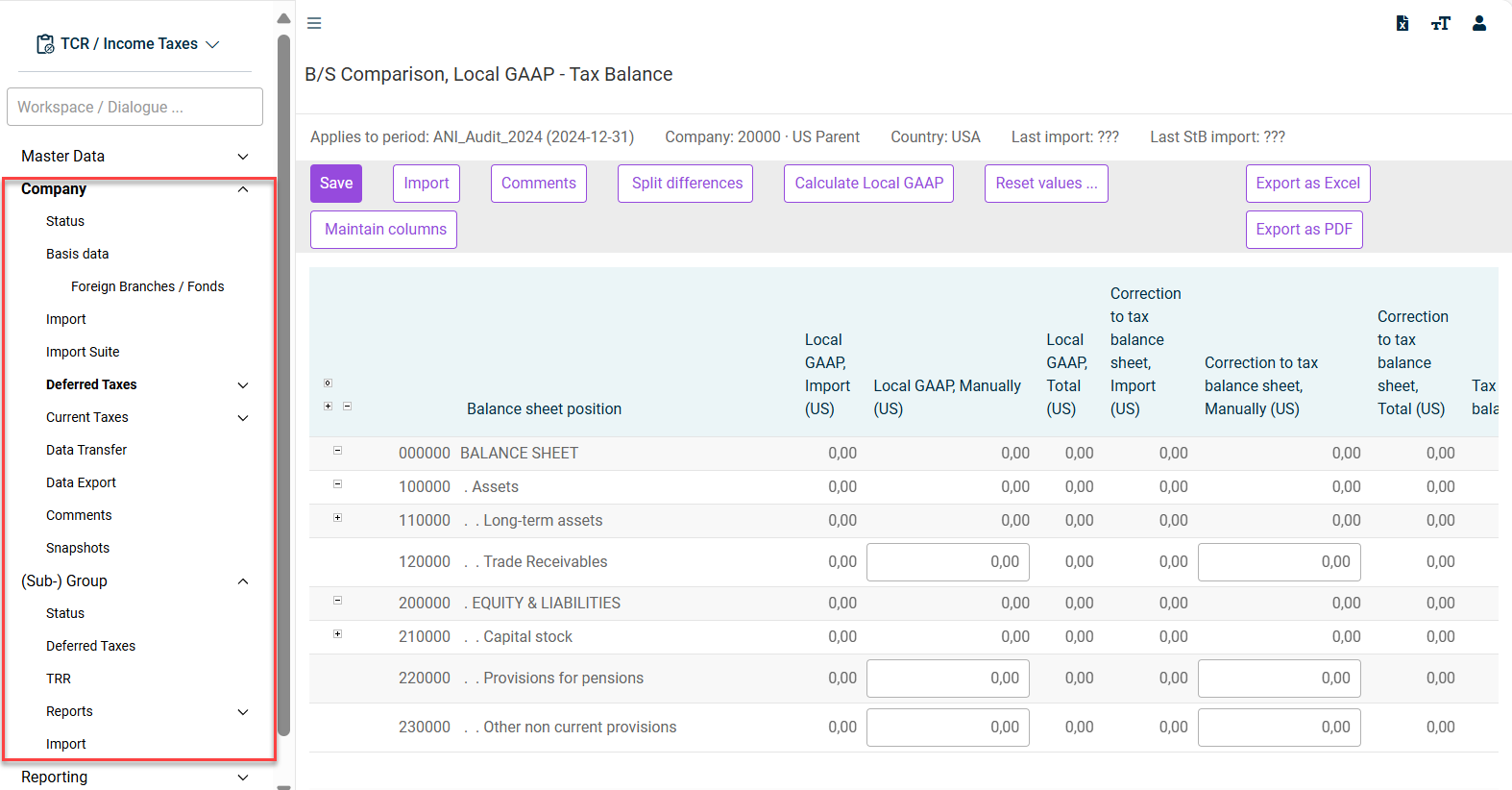

Tax Balance

Our Lucanet Tax Balance module offers the ability to create and maintain a tax balance sheet and to electronically submit it to the German tax authorities as an XBRL-based E-Balance Sheet (E-Bilanz) in accordance with § 5b EStG.

Tax Balance supports all taxonomies published by the German Federal Ministry of Finance for the transmission of the E-Balance Sheet and provides an intuitive user interface.

Key features include:

- Precise modeling of complex corporate structures, including parent companies, intermediate controlling entities, and dependent units

- Adjustment levels for versioning and documentation

- Flexible import options via various file formats, SAP systems, Lucanet databases, and more.

- An intuitive and powerful mapping dialog for effortless assignment of accounts to the taxonomy

- Seamless integration with the Tax Compliance & Reporting solution for direct transfer to the Income Taxes module and efficient preparation of the tax return

- Master data administration for the Global Common Document (GCD) area of the taxonomy

- Complex functions for partnerships, including management of capital accounts, special partner balance sheets and supplementary partner tax accounts, and the mirror image method.

- Multi-year comparisons for transparent analysis across different reporting periods

- Creation and validation of E-Balance Sheets for submission to the German tax authorities

- Reporting functions, such as instance reports of the E-Balance Sheets and balance sheet overviews with tax adjustments

- Do you already use the Lucanet CFO Solution Platform and would like to use Tax Compliance & Reporting as well? Reach out to your Lucanet contact person for the licensing of Tax Compliance & Reporting or get in touch with us at Contact.

- You are not yet a Lucanet customer and would like to know more about our solutions? Then write to us at Contact.