Dependent Business Transactions

Last updated on 2025-07-07

Overview

If accounts or items are planned on the basis of additional planning dimensions, then the business transactions that are dependent on them must be recalculated when these planning dimensions are changed.

In Lucanet, a function can be activated that ensures the automatic recalculation of dependent business transactions. Alternatively, the recalculation of dependent business transactions can be initiated manually.

This article contains the following sections:

Recalculation of All Business Transactions

To recalculate all business transactions:

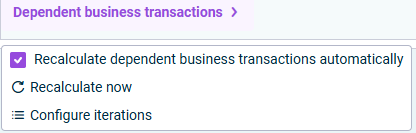

Click Dependent business transactions in the menu bar. A context menu with the following options opens:

Menu options under 'Dependent business transactions'

Select one of the options:

- Select Recalculate dependent business transactions automatically to automatically recalculate transactions if their basis changes, considering the number of iterations set in the system.

- Select Recalculate now to initiate the recalculation of all dependent business transactions.

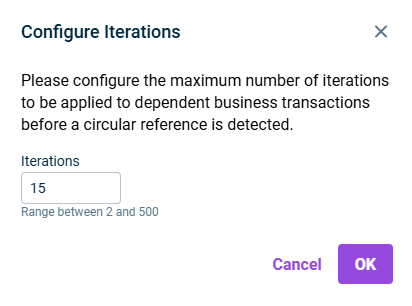

- Select Configure iterations to set or modify the number of recalculation iterations.

'Configure Iterations' dialog

Recalculation of a Single Business Transaction

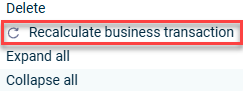

Business transactions with an obsolete calculation basis are indicated by the icon ![]() .

.

To recalculate a single business transaction, right-click an indicated business transaction and choose Recalculate business transaction from the context menu:

Circular References

In some cases, a circular reference can appear between business transactions.

A circular reference can, for example, arise between the Current account interest planning wizard and the Tax calculation planning form. They cannot be dissolved by Lucanet. The following example shows a circular reference:

Business transaction

Description

Tax calculation

- The tax calculation is based on the Earnings before income taxes total line in the P&L.

- The tax calculation planning form generates a posting on the bank account.

Current account interest

- The interest expense or income from the Current account interest wizard is posted to an account which is included in the Earnings before income taxes total line.

- The Earnings before income taxes total line is used as basis for the Tax calculation planning form, thus creating a circular reference.

Resolving Circular References

To resolve a circular reference, you can do one of the following:

- Change the account used for Taxes so it is not included in the basis of calculation of the Current account interest wizard,

- Change the calculation basis for the Current account interest wizard,

- Or increase the number of iterations that can be applied to dependent business transactions before a circular reference is detected.

An iteration is a recalculation loop that continues until all values stabilize and no longer change between cycles (after the second decimal). If values don’t stabilize after the allowed iterations, the system triggers a circular reference error.