Creating and Editing Configurations

Last updated on 2025-07-08

Overview

Before you can execute the consolidation wizards of Consolidation 1, you must create Configurations on the basis of which the consolidation wizards are executed.

This article contains the following sections:

Creating Configuration

To create a configuration:

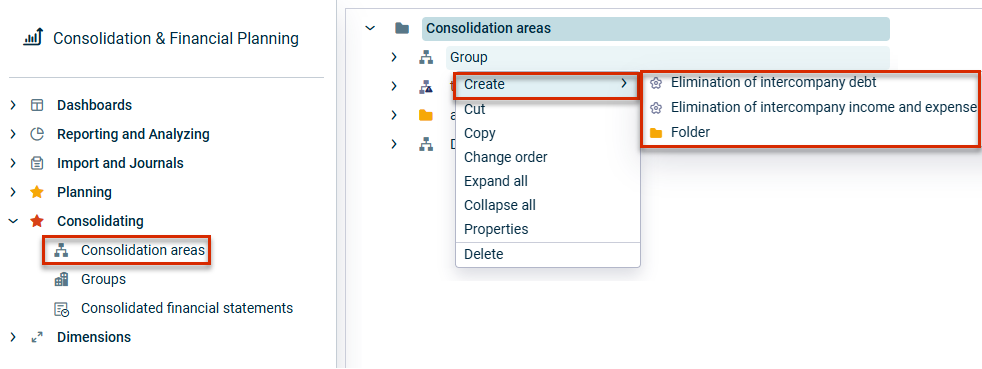

- Open the Consolidation areas workspace in the Consolidating folder.

- Select the desired consolidation area for which you want to create a configuration and select the desired configuration from the Create context menu:

Create configuration - Enter a name for the configuration.

- Select the desired consolidation type (Only for Elimination of intercompany debt and Elimination of intercompany income and expense).

- Click Save or press Enter.

- In the detail view of the configuration, click Edit and configure the configuration (see section Editing Configuration)

Available Configurations

The following configurations are available:

Element

Description

Paired elimination of intercompany debt

Paired elimination of intercompany debt allows you to configure a wizard-supported elimination of debts between affiliated companies of a consolidation area. Pair combinations are formed of all reporting entities or cost centers that are assigned to the consolidation area (see section Paired elimination of intercompany debt).

Lump sum elimination of intercompany debt

Lump sum elimination of intercompany debt allows you to perform a wizard-supported elimination of debts and accounts receivable between affiliated companies. The accounts defined in the wizard configuration are offset against one another on a lump sum basis. By contrast to paired elimination of intercompany debt, no partner information is required for lump sum elimination of intercompany debt (see section Lump sum elimination of intercompany debt)

Paired elimination of intercompany income and expense

Paired elimination of intercompany income and expense allows you to perform a wizard-supported elimination of income and expenses between affiliated companies of a consolidation area. Combined pairs of accounts are formed between reporting entities or cost centers based on pre-assigned partner information as well as the settings made in the configuration (see section Paired elimination of intercompany income and expense).

Lump elimination of intercompany income and expense

Lump sum elimination of intercompany income and expense allows you to perform a wizard-supported elimination of income and expense between affiliated companies. The accounts defined in the wizard configuration are offset against one another on a lump sum basis. By contrast to paired elimination of intercompany income and expense, no partner information is required for lump sum elimination of intercompany income and expense (see section Lump sum elimination of intercompany income and expense)

Elimination of intercompany income and expense based on group-internal revenue

Elimination of intercompany income and expense based on group-internal revenue allows you to perform a wizard-supported elimination of income and expenses between affiliated companies. The group-internal revenue accounts defined in the wizard configuration are offset against one or more expense accounts stating a percentage (see section Elimination of intercompany income and expense based on group-internal revenue).

Editing Configuration

The following options must be configured:

Area/Tab

Description

Name

Name of the configuration

General

In the General area, edit the general properties of the paired elimination of intercompany debt:

- Cost center: Cost center for the postings

Cost centers can be created for the individual consolidation steps below the consolidation reporting entity (see section Creating a Consolidation Reporting Entity).

- Basis: Adjustment level with the data for the generation of the consolidation postings

- Target: Adjustment level on which postings are to be made

Default values

The default configuration for all pair combinations of the consolidation area is performed on the Default values tab:

Area 'Assigned balance sheet items'

- Balance sheet items: Balance sheet items to be consolidated.

Click + Add row to add balance sheet items. - Threshold value for display: If a difference exceeds the entered value, the difference is displayed in red.

- Incorporate deferred tax: Activate the check box if deferred tax should be incorporated.

- Tax rate (in percent of the profit/loss): Tax rate for deferred tax. Displayed when the Include deferred taxes check box is activated.

Area 'Post to'

- Account (Category Default difference account): Default difference accounts to be used to clear the arising differences

- Account (Category Deferred tax): Accounts on which the deferred taxes are to be presented. The row Deferred tax is only displayed when the check box Incorporate deferred tax is activated.

- If necessary, add Partners and Transaction types for each category for the postings.

Transaction types can only be selected for schedule-relevant accounts or items.

Deviating values

Individual configurations can be created for each pair combination on the Deviating values tab:

Area 'Deviating values per pair combination'

- Pair combination: Select the desired pair combination you want to configure.

Area 'Details on the pair combination'

- Define deviating values: Activate the check box if deviating values are to be taken into account for the selected pair combination

- Threshold value for the display: If a difference exceeds the value entered for the elimination of intercompany debt, the difference is displayed in a red font.

- Tax rate (in percent of the profit/loss): Tax rate for deferred tax. Displayed when the Incorporate deferred tax option is activated.

Area 'Post to'

- Account (Category Default difference account): Default difference accounts to be used to clear the arising differences for the selected pair combinations.

- Account (Category Deferred tax): Accounts on which the deferred taxes are to be presented. The Deferred taxes row is displayed when the option Incorporate deferred tax is activated.

- If necessary, add Partners and Transaction types for each category for the postings.

Transaction types can only be selected for schedule-relevant accounts or items.

The following options must be configured:

Area/Tab

Description

Name

Name of the configuration

General

In the General area, edit the general properties of the lump sum elimination of intercompany debt:

- Cost center: Cost center for the postings

Cost centers can be created for the individual consolidation steps below the consolidation reporting entity (see section Creating a Consolidation Reporting Entity).

- Basis: Adjustment level with the data for the generation of the consolidation postings

- Target: Adjustment level on which postings are to be made

Accounts

The default configuration for all pair combinations of the consolidation area is performed on the Default values tab:

- Threshold value for display: If a difference exceeds the entered value, the difference is displayed in red.

- Difference account (debit posting/credit posting): Accounts for postings in debit and credit to which any arising differences are to be posted

- Accounts to be accumulated: Select an account to be accumulated and specify the organization elements to be consolidated in the details window. The following options are available:

- All direct organization elements of the consolidation area, to consolidate only those consolidation units that are directly assigned to the consolidation area (excluding sub-groups).

- All direct and indirect organization elements of the consolidation area, to consolidate also consolidation units in subordinate consolidation areas (including sub-groups; see section Creating and Configuring Consolidation Areas).

- Individual, to compile the consolidation units to be consolidated in the Organization elements list.

The following options must be configured:

Area/Tab

Description

Name

Name of the configuration

General

In the General area, edit the general properties of the paired elimination of intercompany income and expense:

- Cost center: Cost center for the postings

Cost centers can be created for the individual consolidation steps below the consolidation reporting entity (see section Creating a Consolidation Reporting Entity).

- Basis: Adjustment level with the data for the generation of the consolidation postings.

- Target: Adjustment level on which postings are to be made

Default values

The default configuration for all pair combinations of the consolidation area is performed on the Default values tab:

Area 'Assigned P&L items'

- P&L items: P&L items to be consolidated. Click + Add row to add P&L items

- Threshold value for display: If a difference exceeds the entered value, the difference is displayed in red.

Area 'Post to'

- Account: In the Account column, specify the default difference account to which any differences should be posted.

- Add Partner and Transaction type if necessary.

Transaction types can only be selected for schedule-relevant accounts or items.

Deviating values

Individual configurations can be created for each pair combination on the Deviating values tab:

Area 'Deviating values per pair combination'

- Pair combination: Select the desired pair combination you want to configure.

Area 'Details on the pair combination'

- Define deviating values: Activate the check box if deviating values are to be taken into account for the selected pair combination

- Threshold value: Threshold value for the display. If a difference exceeds the value entered for the elimination of intercompany debt, the difference is displayed in a red font.

- Tax rate (in percent of the profit/loss): Tax rate for deferred tax. Displayed when the Incorporate deferred tax option is activated.

Area 'Post to'

- Account: In the Account column, specify a deviating default difference account for the selected pair combination.

- Add Partner and Transaction type if necessary.

Transaction types can only be selected for schedule-relevant accounts or items.

The following options must be configured:

Area/Tab

Description

Name

Name of the configuration

General

In the General area, edit the general properties of the lump sum elimination of intercompany income and expense:

- Cost center: Cost center for the postings

Cost centers can be created for the individual consolidation steps below the consolidation reporting entity (see section Creating a Consolidation Reporting Entity).

- Basis: Adjustment level with the data for the generation of the consolidation postings

- Target: Adjustment level on which postings are to be made

Accounts

On the Accounts tab, specify the accounts to be accumulated:

- Threshold value for display: If a difference exceeds the entered value, the difference is displayed in red.

- Difference account: Account to which the arising differences are to be posted

- Accounts to be accumulated: Select an account to be accumulated and specify the organization elements to be consolidated in the details window. The following options are available:

- All direct organization elements of the consolidation area, to consolidate only those consolidation units that are directly assigned to the consolidation area (excluding sub-groups).

- All direct and indirect organization elements of the consolidation area, to consolidate also consolidation units in subordinate consolidation areas (including sub-groups; see section Creating and Configuring Consolidation Areas).

- Individual, to compile the consolidation units to be consolidated in the Organization elements list.

For elimination of intercompany income and expense based on group-internal revenue, the following options must be configured:

Area/Tab

Description

Name

Name of the configuration

General

In the General area, edit the general properties of the elimination of intercompany income and expense based on group-internal revenue:

- Cost center: Cost center for the postings

Cost centers can be created for the individual consolidation steps below the consolidation reporting entity (see section Creating a Consolidation Reporting Entity).

- Basis: Adjustment level with the data for the generation of the consolidation postings

- Target: Adjustment level on which postings are to be made

Base and target accounts

On the Base and target accounts tab, specify the accounts for reporting the group-internal revenue (base accounts) and the contra accounts (target accounts). Define the share in percent of the target account.

- Base accounts: Accounts for the calculation of group-internal revenue

- Target accounts: Accounts for the contra entry

- Share: Percentage share of the target account

Organization elements to be consolidated

You must specify the organization elements to be consolidated for each base account. As soon as you select a base account, more options are displayed:

- All direct organization elements of the consolidation area: Only those consolidation units that are directly assigned to the consolidation area (excluding sub-groups) are consolidated.

- All direct and indirect organization elements of the consolidation area: Consolidation units in subordinate consolidation areas are also consolidated (including sub-groups; see Creating and Configuring Consolidation Areas).

- Individual: Individual selection of the consolidation units in the Organization elements list.