VAT/Input VAT Administration

Last updated on 2025-12-08

Overview

For the purposes of planning in Lucanet, it is possible to create VAT and input VAT configurations that can be taken into account as part of the configuration of accounting rules for accounts and items in the general ledger and subledgers.

This article contains the following sections:

Creating VAT Configurations

To create a VAT configuration:

- Open the Accounting rules workspace.

- In the dimension bar, click the VAT button. The VAT configuration dialog is displayed.

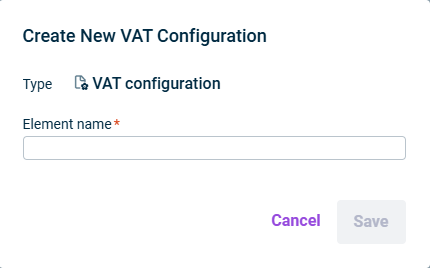

- Right-click a journal folder in the tree view, then select Create VAT configuration from the context menu. The Create New VAT Configuration dialog is displayed:

'Create new VAT configuration' dialog - Enter a name for the VAT tax configuration in the Element name field.

- Click Save.

Configuring VAT Configurations

To configure a VAT configuration:

- In the dimension bar, click the VAT button. The VAT configuration dialog is displayed.

- Select the combination of data level and reporting entity for which you want to edit the VAT configuration.

- In the tree view, select the desired VAT configuration.

- Click Edit in the top right to open editing mode.

The following configuration options are available:

Tab

Description

Configuration

Percentage

Tax rate of the VAT/input VAT in percent

Basis

Periodicity for the tax calculation

Payment to the tax authority

Indicates when the tax liabilities will be paid (see Configuring cash flow impact)

Disclose VAT/input VAT by

The time for the disclosure of the VAT/Input VAT

The chosen time for Disclose VAT/input VAT by is taken into account only for accounting rules with the down payment transaction payment type.

Posting

Bank account: An account from which the particular tax should be paid

Sales account/input tax account: An account for which the liabilities or receivables should be indicated in the balance sheet

Applying VAT Configurations to Other Journals

VAT configurations always apply to a journal, i.e. a particular combination of data level and reporting entity. To avoid creating a new configuration for each journal it applies to, you can either copy or move a VAT configuration to individual journals or you can apply a VAT configuration to multiple journals at the same time.

To apply a VAT configuration to multiple journals:

- Open the Accounting rules workspace.

- In the dimension bar, click the VAT button.

- Select the combination of data level and reporting entity from which you want to apply the VAT configuration to other journals.

- Click the

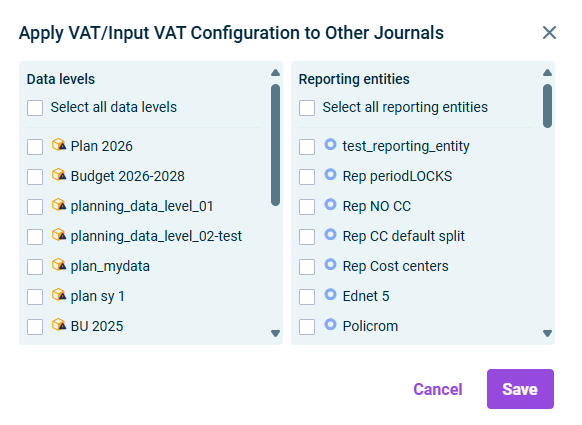

button or right-click the VAT configuration and choose Apply VAT/Input VAT Configuration to Other Journals. The following dialog is displayed:

button or right-click the VAT configuration and choose Apply VAT/Input VAT Configuration to Other Journals. The following dialog is displayed:

'Apply VAT/Input VAT to other journals' dialog - Select the Data levels and the Reporting entities into which the VAT configurations are to be transferred.

- Click Save.

Copying and Moving VAT Configurations

You can also copy or move a VAT configuration within a journal or to another journal.

To copy or move VAT configurations:

- Open the Accounting rules workspace.

- In the dimension bar, click the VAT button.

- Select the combination of data level and reporting entity from which you want to apply the VAT configuration to other journals.

- Right-click the VAT configuration and choose Copy or Cut.

- Select the combination of data level and reporting entity into which you want to copy or move the VAT configuration.

- Right-click the root folder of the journal and choose Paste from the context menu.