Income Taxes

The Lucanet module Income Taxes provides a central and flexible platform for comprehensive tax management, helping companies efficiently fulfill their tax obligations while ensuring compliance. The solution optimizes every aspect of tax processes and provides an intelligent platform that manages the entire tax lifecycle.

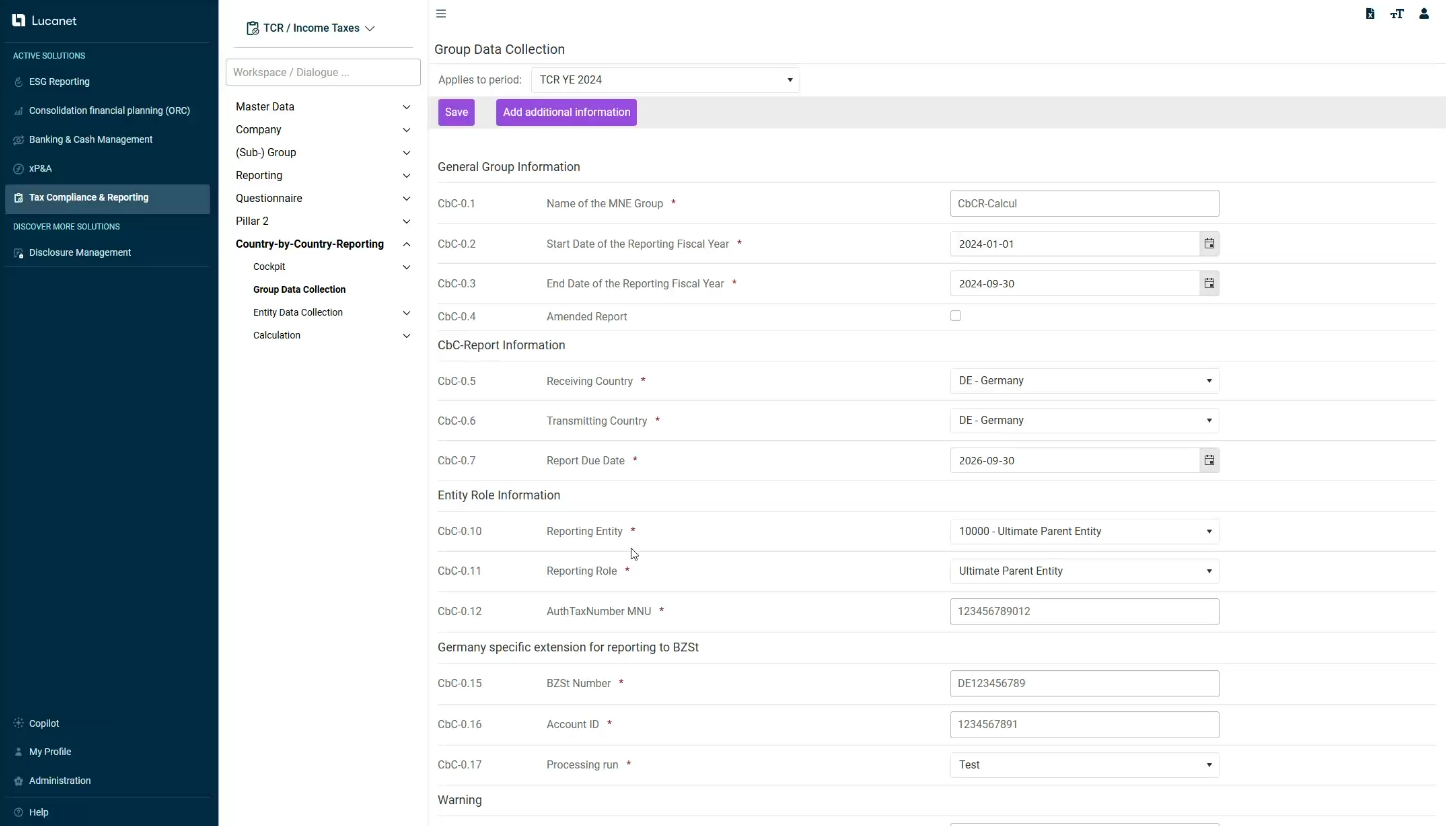

Income Taxes combines the sub-modules CbCR, Pillar 2, Tax Accounting, Tax Compliance, Tax Return, and Tax Questionnaire under one roof.

Income Taxes automates, connects, and standardizes data securely across different reporting units and regions. The module generates accurate, transparent reports with detailed tracking that records relevant data changes, promoting trust throughout the organization. Income Taxes ensures compliance with regulations such as Pillar 2 and IFRS through optimized data collection and CbCR-compliant reporting.

Income Taxes has the following features, among others:

Tax calculation and compliance: Income Taxes integrates both current and deferred tax calculations. The flexible configuration of company-specific parameters and the mapping of different company structures enable precise adaptation to individual requirements.

Process integration: Income Taxes seamlessly integrates tax calculation, tax return, and quarterly and annual reporting processes, optimizing the entire tax management lifecycle.

Data analysis and reporting: The integrated reporting engine and flexible export options to external posting and BI systems support detailed analysis and transparent tax reporting.

Documentation options: Various documentation options are available, including the ability to integrate Excel calculations, which gives users flexibility in documenting tax-related information.

Company master data: Income Taxes enables comprehensive master data administration to cover the requirements of all sub-modules. Master data can be maintained centrally, including company-specific exchange rates and tax rates, if applicable.

Reporting dimensions: Reporting dimensions can be created for data analysis purposes, e.g., differentiation by region or industry. Companies can be assigned to the dimensions and data can be analyzed on this basis.

Reporting periods: Master data and transaction data are managed based on previously created reporting periods. Data can be transferred from other periods. Periods can be closed and compared to analyze changes.

Milestones: Milestones enable you to track the status of individual companies and the group as a whole. Statuses such as Not started, In progress, Completed and Reviewed are linked to plausibility rules.

Reporting: Standardized tax reports can be parameterized in terms of comparison period, company, scope (individual companies, tax groups, group), currency (own currency, group currency) and presentation (transposed views). Tax reports can be combined using user-defined reports to create new reports.

Interfaces: External data can be imported and calculated data exported. Mapping logics enable flexible assignment according to individual requirements. Interfaces to SAP and non-SAP ERP systems as well as to other reporting solutions enable seamless data exchange and smooth integration.

- Do you already use the Lucanet CFO Solution Platform and would like to use Income Taxes as well? Reach out to your Lucanet contact person for licensing of Income Taxes, or get in touch with us via Contact.

- You are not yet a Lucanet customer and would like to know more about our solutions? Simply get in touch with us via Contact.

The documentation for Income Taxes can currently be found in an external knowledge base under Income Taxes - Lucanet - TCR Documentation. We will update and integrate the documentation here as soon as possible.

Getting Started with Income Taxes

Our instructions will help you get started with Income Taxes in next to no time: